Annual rate of depreciation formula

In the first year multiply the assets cost basis by 515 to find the annual. According to straight-line depreciation this is how much depreciation you have to subtract from the value.

Annual Depreciation Of A New Car Find The Future Value Youtube

For example in a 12 period year if an.

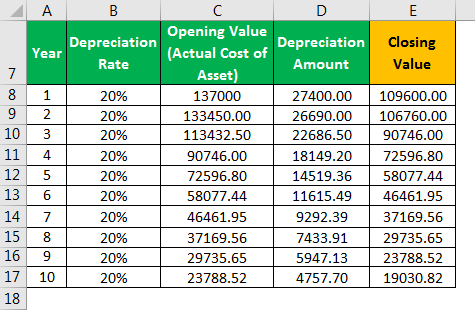

. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. 5 hours ago Each periods depreciation amount is calculated using the formula. Depreciation Amount for year one 10000 1000 x 20.

For an asset with a five-year useful life you would use 15 as the denominator 1 2 3 4 5. To calculate the depreciation of building component take out the ratio of years of construction and total age of the building. Depreciation Amount for year one Book Value Salvage Value x Depreciation Rate.

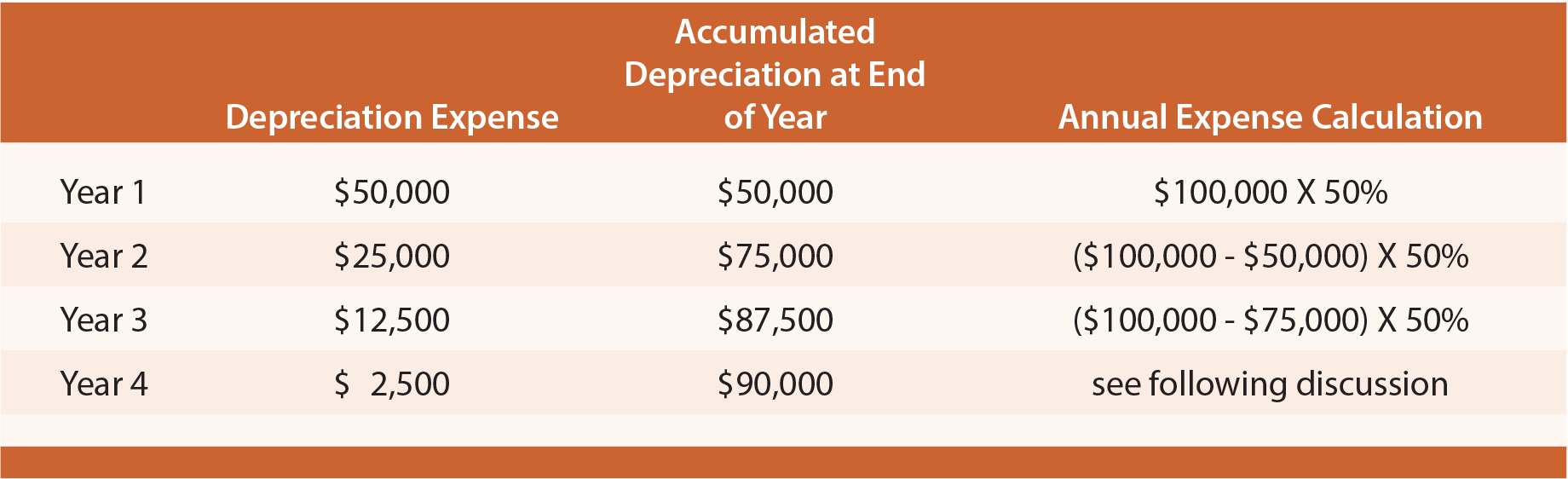

Rate of depreciation x 100 Diminishing balance or Written down value or Reducing balance Method Under this method we charge a fixed percentage of depreciation on the reducing. For instance if a buyer is selling a property after 10. Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful life is 25.

The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. The first cost of a machine is Php 1800000 with a salvage value of Php. Total depreciation Annual depreciation n 71 2 n n 355 years Problem 2.

Annual depreciation rate number of periods in the year. Calculating Depreciation Using the Units of Production Method. Annual depreciation purchase price - salvage value useful life.

Asset cost - salvage valueestimated units over assets life x actual units made. The DDB rate of depreciation is twice the.

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Gt10103 Business Mathematics Ppt Download

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Calculation

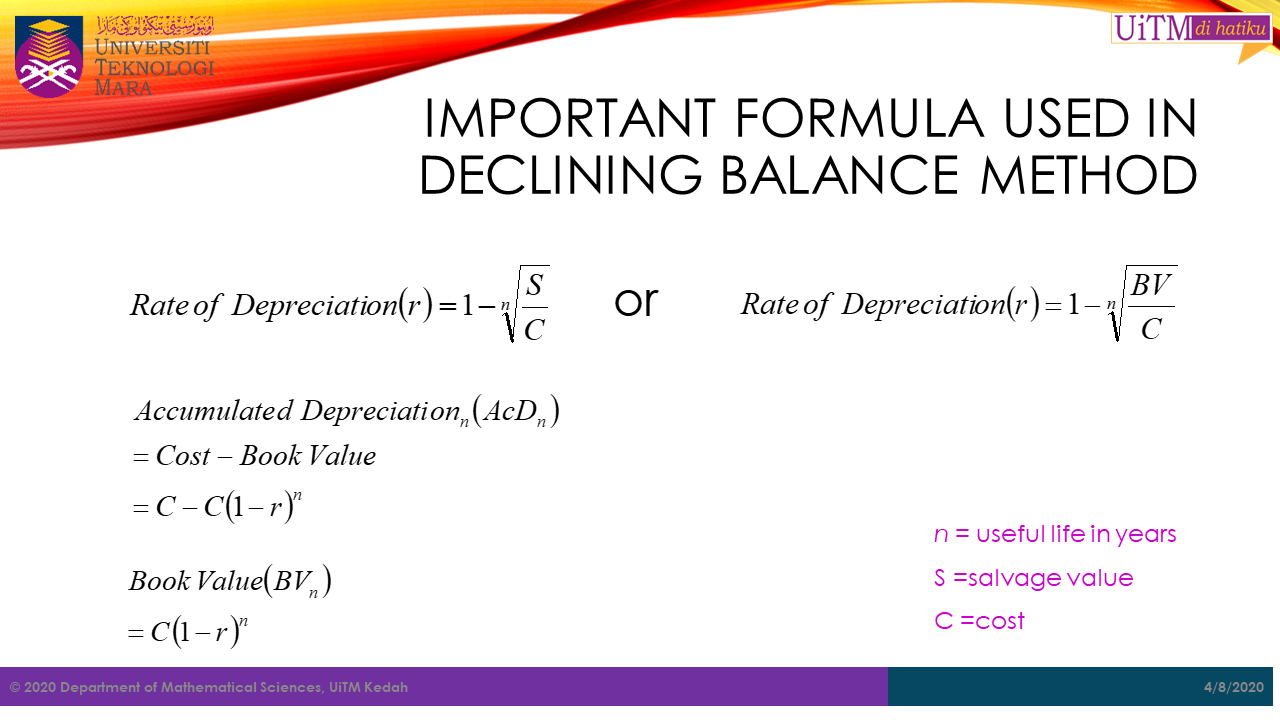

Math Sc Uitm Kedah Depreciation

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Calculate Depreciation Expense

Lesson 8 8 Appreciation And Depreciation Youtube

Depreciation Formula Examples With Excel Template